I Just Seriously Cheap Flights: Two Roundtrips For About $22…Total!

Here’s How I Got Two Cheap Flights…Rountrip…On American Airlines By Using Points

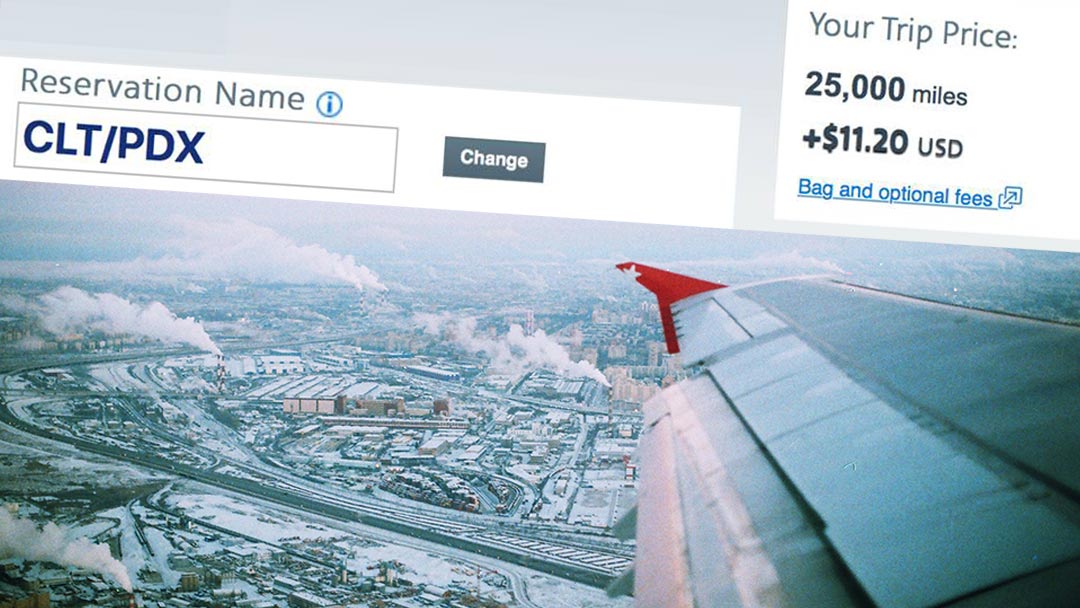

A couple of days ago I bought two roundtrip tickets within the continental US on American Airlines (AA for the rest of the article) for a grand total of…wait for it…$11.20 each. The of these cheap flights is Charlotte to Philly, and the second is from Charlotte to Portland (via LAX). Oh, and I’ll probably stay super-expensively at hostels for around $35/night while I’m there. That wasn’t actually sarcasm. I’m writing this article from a $15 campsite in Shenandoah National Park, which I think is kind of pricey. #cheapskate

The real cost of those tickets was $11.20 each, and redeeming about 30,000 credit card award miles.

Litigation repelling disclaimer…

OK, first things first, I’m not a financial advisor, but my friends and family will attest that I’m pretty good with my loot and I’ve made some pretty good choices in the past ten years or so. A lot of them ask me for advice, so I must not be that much of a hack monkey. You can’t sue me if you go out there and get all batsh*t crazy on some credit cards and go all chapter 11. But even if you do, you’ll be enjoying some cheap-ass trips, so…umm…you’re welcome?

The real cost of those cheap tickets

So back to it. This isn’t going to go too deep into detail, but just into the surface of travel credit cards and how you can start to play the game, even minimally, and win.

Those tickets I mentioned above actually cost me $11.20 (mandatory taxes and fees) each plus about 30,000 award points, in total. Those reward points are typically earned when you spend on a credit card. You’ll see a lot of promotions like “2% cashback” or “this many points per dollar”, etc. They’re all different. Many of those cards actually give you award points for purchases that are for…umm, travel? Yeah, win-win.

If you’re sh*tty at your finances, sorry, this isn’t for you

The first and foremost rule for getting into this is that you absolutely can’t run a balance on your credit cards to win this game. Or any credit cards for that fact. I have no accounts where I’m losing interest fees other than my home at the moment, and that mortgage is generally seen as a necessity or as “good debt”. But if I were losing $20 a month on a couple of different cards, what point would I have playing this game? It’s essentially a moot point at that rate.

The first step here would be to rid yourself of debts and credit accounts where you’re losing money on a regular basis, then start playing the credit card bonus game. Then you’re winning on all fronts, and the rewards aren’t being offset by other losses. So if you’re in debt, feel free to read and plan for doing this down the road, but I suggest you wait, buy (and follow) a book like Total Money Makeover, then start this when the time is right and you’re losing zero to other interest-based accounts.

BTW, with that book and some intestinal fortitude I paid off about $50,000 of debt in just over four years during my late 20s. Highly recommend.

Perks of the Cards

The fun doesn’t usually stop at free award points. Since there are so many cards out there that offer free award points, many of those cards add unique bonuses to entice a consumer to go with their card as opposed to another. The AA card I mentioned also gives one free checked bag on AA flights, specifically, as well as priority boarding. Some cards give rental car bonuses, hotel stays, etc. You just have to do your research and find which fits best for you.

One Barclay card (Arrival, I think it is) lets you spend your points on gift cards or on travel-related purchases. So instead of using it on a specific airline’s site, you can go to any travel-related site, like Skyscanner or Orbitz or the like, and buy a ticket or room with that card. Since those sites are travel-related, you then simply spend award points (through the card’s website) when the next statement comes out to offset that cost. Pretty handy. They’re all different so do your homework.

A specific airline’s card might not be your first go-to if you don’t live in a hub city, like me, or if you’re more of an overlander.

Team up

Most of these offers require an initial $3-4000 total spending on the card in the first couple of months to get the bonus. Don’t usually spend enough to hit the entry requirements over the first few months? There’s help if you’re a little creative.

Many people aren’t interested in playing these games so they’re not really worried about losing (or acquiring at all) a chunk of points. If your mama is looking to buy some new furniture, plan ahead and ask if she’ll let you put it on your card, and then she can just pay you back. Get creative. Going out to dinner with friends? Tell them to give you cash and put it on your card. Now, don’t make it a habit, as this is really only to get you through your required spend period.

Another thing you can often do is to actually go buy gift cards. If you know you’re $200-300 away from hitting your needed mark for that month/period, head to the local grocery store and buy some gift cards. You have to eat my friend! Then you’ve used your CC to hit the mark, and you have some food money for months to come. You can also do this for certain gas station chains, especially useful for overlanders like me that get a whopping 10mpg. Blerg.

Depending on the card, just make sure there’s nothing against this in the fine print.

Using your points

Well, here’s where it gets tricky. The whole point of these credit card companies is for them to make money, and not for you to work the system. They kind of rely on people not using their points, or on the fact that folks don’t manage their money well, end up paying interest, thus offsetting their awards. The companies are also notorious for not making it easy to redeem. Some of the backend redemption portals can be pretty tricky, so you have to be patient, look around a lot, and learn to use your specific card’s portal. Once you do it will get easier.

Do your homework for your specific card

Some redemptions are very specific. My AA card is specifically for AA redemption. No gift cards, no other airlines (unless they’re partners), no “travel-related” redemptions. That means that I might get great or free deals, but they’re only on AA or through their site. Even if I plan a trip through their portal, with one of their flights, and I don’t realize a connection on that itinerary is with another airline, I may take my initial free checked bag for granted and then get hit with a checked bag fee on the connecting airline.

Some of this is trial and error (yes, I paid to learn that lesson), so you just have to do your homework and spend the time researching.

Date ranges and buying ahead

I literally had two friends message me after I mentioned on Facebook that I had gotten that cheap flight to Philly for $11.00, wondering why they were getting $85 costs. They were literally online looking at the same time I was. Because I have experience with the whole trial and error, I knew that if you’re purchasing within 60 days of a trip on this particular card, they hit you with a huge fee…well, huge compared to $11.20!

So you need to be plan ahead to take full advantage and avoid the quick trips. Sometimes you can find cheap quick trips, but I’ve found that it’s pretty tough.

Set your timer: 1 year and counting…

Most cards that have killer bonuses have a fee, but many will waive it for the first year. I highly suggest you go that route, then plan to close that card within the first year. The kicker is that if you close the card and still have award points on it, you’ll lose them. So use them early and often, then close it down! 50000 miles often equates to something like $500 worth of free flights, if not better, but you don’t want to reduce that win by $80-$400 if you get hit by a yearly fee.

Some people choose to keep a card long-term because the ongoing benefits are just so good, so don’t be afraid to keep one if it works for you!

Flipping credit cards for more bonuses

So now you’ve got a card, you’ve met your initial spend requirements, gotten your points, bought some cheap flights, and depleted your points. If you’re feeling frisky, it’s time to think about your next card! Since there are dozens of card originators out there, it’s not unlikely that you can switch cards every six months or so (some people do it way more often) and reap the benefits.

Just keep in mind that most companies have figured out that they need to prevent this by not allowing a person to get the same bonus or card within about two years of the last time. Have a partner? Well, there’s an out. The two of you can trade off on cards or companies and work the system a little more. Again, do your research.

But what will this do to my credit?

Well, head back up to point number one and you’ll find your answer. But to elaborate, we’ve already gone over the fact that you shouldn’t have a ton of running debt if you’re playing this game. That likely means you’re not a credit risk and that filling out for a new card (which you’re always paying off…) once or twice a year isn’t going to harm you. But that’s your call and everyone’s different. Personally, I keep an eye on my credit report regularly and ask questions if I see anything getting negatively affected. But I’ve never had an issue. I recommend you do the same, regardless of whether you’re flipping cards.

There you go. This is a deep subject, and there are many layers to the onion, but just getting started with this will start yielding you some quick trip wins and get your wheels turning! Again, I’m not a financial advisor, blah, blah, blah, and you need to take responsibility for your choices. But most of this stuff is fairly common practice for those of us in the know and doing the budget travel thing.

Now, to start looking at those hotel chain cards and all of their perks…

Cheers!

— Jason

Travel Planning Tips

Figure out where you are going & how are you getting there…

I suggest using at least 2 to 3 different travel search sites. Start with Skyscanner or Orbitz or Booking …or whatever aggregator site you prefer. Then when you see what airlines to use, check their respective sites for better deals or rewards flights.

Figure out where you’re going to stay…

If you’re interested in hostels, search Hostelworld or Hostelling International. For longer-term or more private digs, look at Airbnb, VRBO, or you can look for hotel rooms in the links from the search engines listed above.

Get comprehensive travel insurance, or in the least, travel medical insurance if internationally…

Especially with Covid not going anywhere, get covered. Start with an insurance aggregator like Insure My Trip, or with SafetyWing, World Nomads, or another. Then decide what is important to you; trip cancellation, baggage coverage, medical, or all of the above. And get a yearly evacuation plan, since you’ll have to get home after your emergency!

Need more resources? Click here!

This site participates in the Amazon Services LLC Associates Program and other affiliate programs and may earn from qualifying purchases. You’re never charged more, but it helps out little by little! Check out “Privacy” in the top menu if you need to know more!